Álvaro Sánchez

⦿ Quantitative Researcher/Developer

⦿ PhD Candidate in Financial Machine Learning

⦿ Double MSc. in Aerospace Engineering

I’m a Quant Researcher/Developer with a strong technical background (PhD + 2 MSc), and

a great passion for the intersection of Math/Statistics, Artificial Intelligence & Finance:

More than 2.5 years of professional experience developing and supporting investment

strategies as Quant Researcher & Developer at Morgan Stanley.PhD Candidate in ML/AI applied to Financial Time-Series Forecasting & Portfolio Optimization

MSc in Space Systems (ISAE-Supaero), MSc in Aerospace Engineering (ULe),

BSc in Aerospace with Minor in Mechanical Engineering (UWGB, USA)CFA Level I - Passed

Strong technical background with demonstrated knowledge and expertise in Mathematics, Probability & Statistics, Computer Science, Data Science, AI & Quantitative Finance.

Passionate about Quantitative Trading and Research.Professional Experience in Top Finance & Space Companies (MS, ESA, DLR, Thales A. Space)

in 5 different countries (Spain, USA, France, Germany, Hungary)Fluent in Spanish, English and French

★ Introduction

About Me

I was born in Leon, a small city in the north of Spain. I graduated with a BSc in Aerospace Engineering at the University of Leon, with minors in both Electronic and Mechanical Engineering. In the last year of my Bachelors, I was awarded with a scholarship to study in the University of Wisconsin Green-Bay (USA), where I graduated with Highest Honors and started developing an interest in the fields of Space and Finance.

Years of experience in top

finance & aerospace companies

Years of higher education in Engineering, AI & Finance

After realising it aligned much better with my long-term career plans and desired skillset, I decided to focus on the financial sector. As of now, I’ve been working for 2.5 years as Quant Researcher & Developer at Morgan Stanley, developing and supporting investment strategies for the New York Fixed Income trading desk.

Over these years, I have found great fulfillment in integrating professional endeavors with academia and research. I feel I still have a lot to learn about quantitative finance and investing, therefore in parallel to my full time job I am pursuing a part-time PhD in Artificial Intelligence applied to Asset Price Forecasting and Portfolio Optimization. Also, I’ve developed several pesonal projects related to Quantitative Finance (see below).

In the next 3 years after my bachelors, I obtained the CFA Level I and completed two Masters of 2 years each: a MSc in Aerospace Engineering at the University of Leon, and a second MSc in Space Systems at ISAE-Supaero (France), one of the leading Aerospace universities in Europe.

During that period, apart from my studies I also acquired professional experience in diverse fields across 5 different countries. I did internships as AI Researcher at Drotium, an unmanned vehicles start-up; as Astrodynamics Mission Analyst at the German Space Agency, optimizing lunar ascending orbits; and as Satellite Control Researcher at Thales, performing statistical analysis in the positioning of EROSS+ satellite. I was also selected by the European Space Agency (ESA) as one of 30 European students to assist the 2020 Space Innovation Workshop.

In my free time, love practicing and/or watching any type of sport. I used to play handball in high school (my team won Spanish championship U-14). Nowadays, I do weights/cardio every day and try to stay updated on most major sport competitions (my favorite these days are tennis, F1, NBA and NFL). I also love coding and web design, reading productivity/ self-improvement books, and going to the Opera (my favorite is Bizet’s Carmen).

Hours of deliberate practice

in quantitative skills

Personal Projects in

Quant Finance & Trading

+3 Years Professional Experience at top

Investment Banks & Space Companies

I have 2+ years of professional experience in the finance industry as a Quantitative Developer/Researcher at Morgan Stanley, Fixed Income Division. More information here.

Previously, I interned as Satellite GNC Engineer (Thales. A. Space, France), as Astrodynamics Research Engineer (Germany Space Agency, DLR), and as Artificial Intelligence Researcher at the start-up Drotium (Spain).

-

2+ years of experience developing and supporting algorithmic models and quantitative strategies.

-

Developed and customized Monte Carlo and Linear Covariance Analysis tools to perform statistical analysis in the uncertainty of EROSS+ satellite positioning.

-

Developed Non-Linear Programming (NLP) Optimal Control solver in Python, to optimize lunar ascending trajectories under different scenarios and constraints.

-

Worked in a group of 4 engineers conducting research and developing an innovative poistioning network for unmanned vehicles, by means of Artificial Intelligence and genetic algorithms.

-

Part-Time PhD in Artificial Intelligence applied to Financial Time-Series Forecasting and Portfolio Optimization.

-

MSc in Space Systems at ISAE-Suparo (Toulouse, France)

-

MSc in Aerospace Engineering (University of Leon, Spain)

-

Major in Aerospace Engineering (Leon, Spain)

Minor in Electrical Engineering (Leon, Spain)

Minor in Mechanical Engineering (USGB, USA)

-

CFA Level I passed above 90% of participants.

-

⦿ Knowledge:

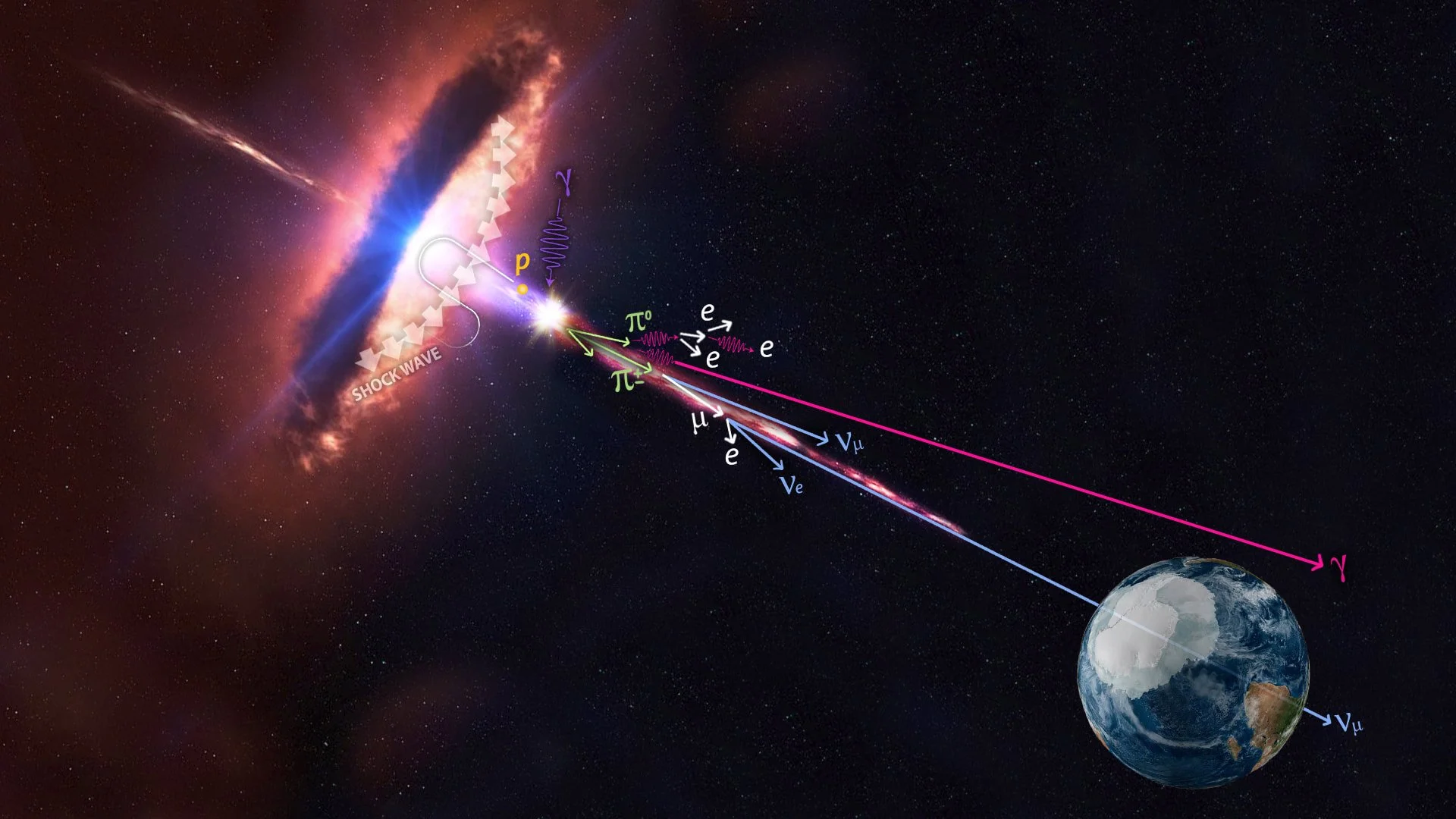

7+ years of education in Aerospace Engineering, understanding and modeling physical phenomena using mathematical and differential equations.

Courses in Algebra, Calculus, Optimization, Aerodynamics, Orbital Mechanics, Astrodynamics…

⦿ Expertise:

Propagated Rocket Equations of Motion and Optimized Lunar Ascending Trajectories for Moon-Earth Spatial Mission at German Space Agency (DLR).

Developed model of Guidance Navigation & Control (GNC) for EROSS+ satellite at Thales Alenia Space to study position uncertainty.

Created GitHub Library with dynamics models and equations of motion for aircraft flight dynamics, rocket equations, astrodynamics…

-

⦿ Knowledge:

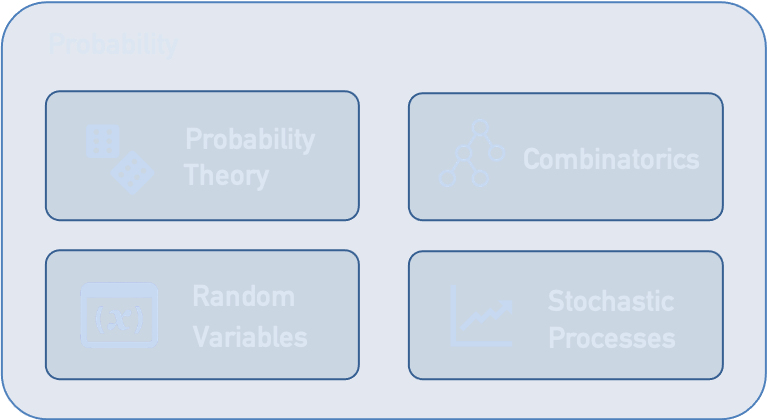

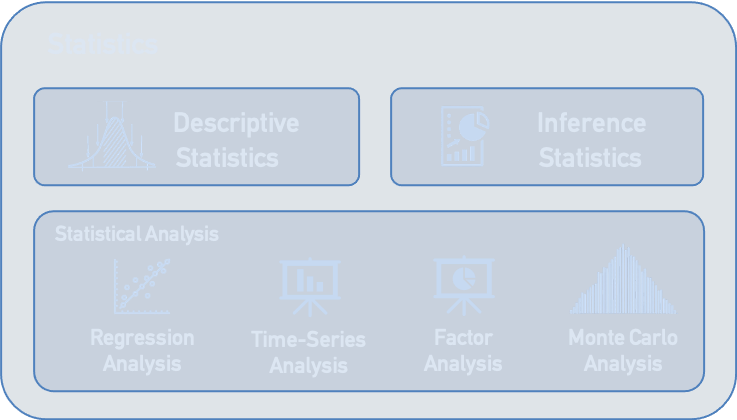

Courses in Probability Theory, Stochastic Processes, Descriptive Statistics, Hypothesis Testing and Statistical Methods (Regression, Time-Series Analysis, Monte Carlo simulation..)

⦿ Expertise:

Implemented Monte Carlo and Linear Covariance Analysis Models to calculate uncertainty in satellite positioning system at Thales Allenia Space.

Created GitHub Repository with collection of probability and statistical models, including stochastic processes, outlier detection, regression models…

-

Programming Languages - Python (advanced), C++, JAVA, q/kdb, SQL.

Software/Libraries - Excel, MATLAB, R, Pandas, Scikit-learn, Tensorflow.

DevOps - Git, Linux, OOP, SDLC, CD/CI.

DSA - advanced expertise in Data Structures and Algorithms (see personal GitHub repository)

Projects:

Coded PacMan game in C++ (see in Git)

Coded Monopoly game in JAVA (see in Git)

Developed several projects in Python (OOP). See my projects section below.

-

⦿ Knowledge:

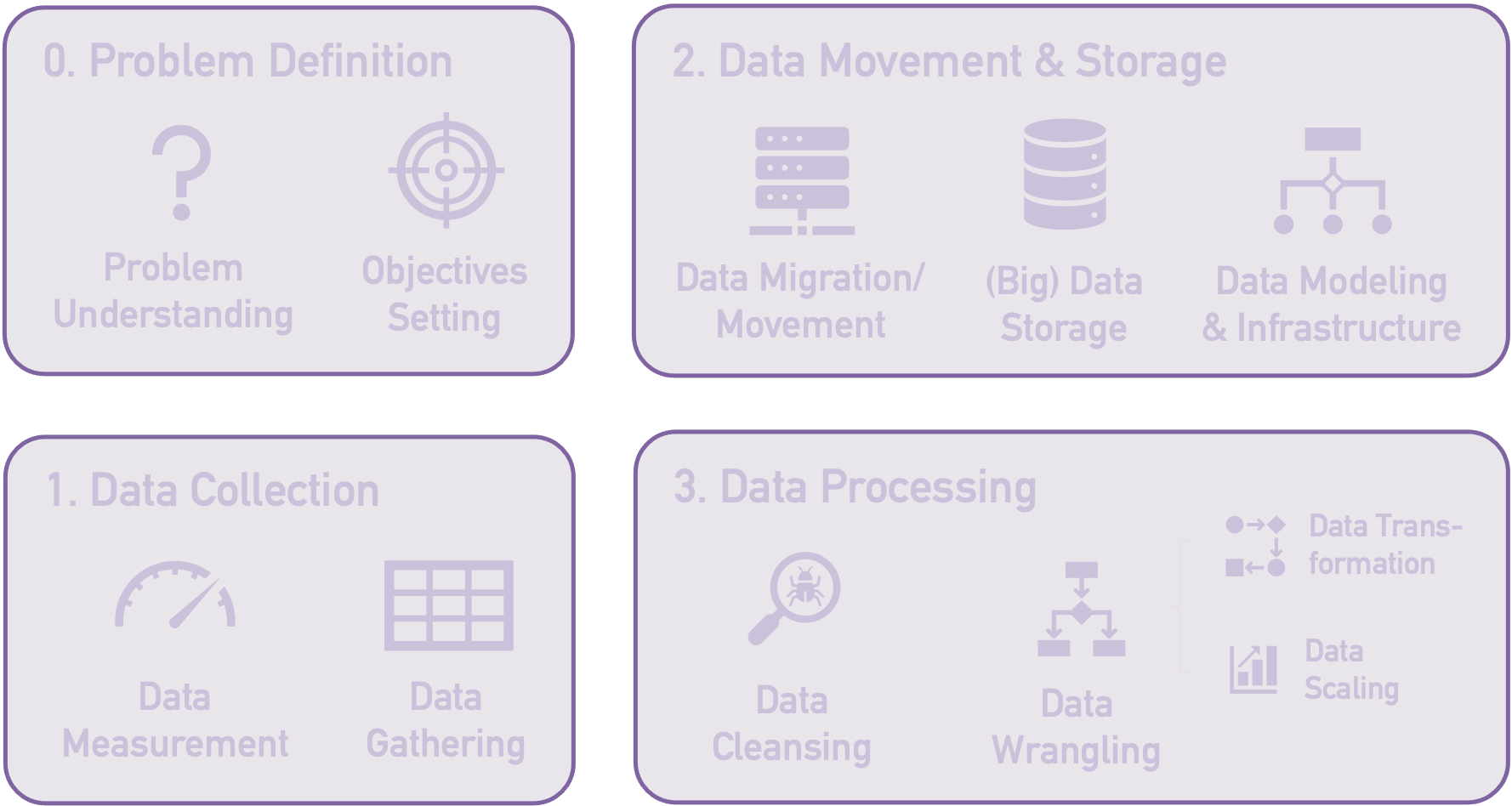

Google Data Analytics Certification - 240h specialization course on all steps of Data Science (data collection, storage, manipulation, cleaning, data analysis, predictive data analytics, data visualization and presentation, data governance and monitoring)

⦿ Expertise:

More than 3 years professional track record in top space and financial companies performing data engineering operations, creating quantitative models and leveraging cutting-edge quantitative techniques to extract actionable insights from complex databases.

-

⦿ Knowledge:

Courses in Machine Learning Algorithms applied to Finance (unsupervised, supervised, k-means clustering, PCA, random forest, neural networks...)

Familiarity with basic optimization heuristic techniques and genetic algorithms.

⦿ Expertise:

2024, Conference Paper Publication (Artificial Intelligence Applications in Portfolio Selection Problem: A Review and Future Perspectives)

2019, Conference Paper Publication (Genetic Algorithm Optimization of Lift Distribution in Subsonic Low-Range Designs)

-

CFA Level II - Candidate

Courses in main quantitative finance fields: equities pricing, bond pricing and IR modeling, derivatives pricing models, volatility models, hedging strategies, portfolio optimization techniques, risk management, quantitative trading strategies.

I find great fulfillment in integrating professional endeavors with academia and research. Particularly, I feel a deep interest in the intersection of Math/Statistics, Artificial Intelligence and Quantitative Finance.

That’s why concurrently with my full-time job, I’m also pursuing a part-time PhD in Artificial Intelligence applied to Financial Time-Series Forecasting and Portfolio Optimization. More information here.

Previously to my PhD, I completed my Bachelors in Aerospace Engineering (ULe) with a minor in Mechanical Engineering at UWGB (USA), a MSc in Aerospace Engineering (ULe) and a second MSc in Space Systems at ISAE-Supaero.

Strong Quantitative Skillset

Portfolio of Projects

10+ years of Higher Education in Engineering, AI & Finance

★ Experience

Professional

Experience

I have 2+ years of professional experience in the finance industry as a Quantitative Developer/Researcher at Morgan Stanley.

Prior to that, I interned as Satellite Control Engineer (TAS, France), as Astrodynamics Researcher (Germany Space Agency, DLR), and as Artificial Intelligence Researcher at the start-up Drotium (Spain).

★ Education

Education

I find great fulfillment in integrating professional endeavors with academia and research. Particularly, I feel a deep interest in the intersection of Math/Statistics, Artificial Intelligence and Quantitative Finance.

Thus, concurrently with my full-time job I’m also pursuing a part time PhD in Artificial Intelligence applied to Financial Time-Series Forecasting and Portfolio Optimization.

Previously to my PhD, I completed a Bachelors in Aerospace Engineering (ULe) with a minor in Mechanical Engineering at UWGB (USA), a MSc in Aerospace Engineering (ULe) and a second MSc in Space Systems at ISAE-Supaero.

★ Skills

Skills

During my first M.Sc. in Aerospace Engineering, I started becoming interested in finance. After a few months learning from different sources, I found the CFA materials and decided to prepare for the CFA I exam on my own. To my surprise, I found more motivation in this endeavor than in any of my university courses. By the time I completed my second M.Sc., I had successfully passed the CFA Level I. After a couple of internships in the Aerospace Industry I realized I wanted to explore a different path. Whether it was the right decision was unbeknownst to me at the time, but I felt compelled to pursue a career in finance –or at least give it a try.

It was in that context when the idea of understanding a long-term view became important to me. I was aware that finance is one of the most competitive fields in the world. I knew top people prepare for years just to have a chance to enter the industry. I knew I wasn’t going to catch these people in a few months, or even in a year or two. I knew it was going to be a marathon. So I sat down and said: “okay, if I want to do this for a living, and I want to be good at it, this is gonna take some thought. What are the fundamentals I need to master in order to catch up and succeed in this industry? What do I need to work on first?”

“The idea of understanding a long-term view became important to me. I knew I wasn’t going to catch up in a year or two. It was going to be a marathon”.

”What are the fundamentals that I need to master to succeed in finance? What do I need to work on first?”

I did a lot of research on the fundamentals of finance — specially quantitative finance, which I felt specially attracted to due to my technical background. I went through the CFA materials, main financial books, syllabus of renowned financial institutions, blogs, scientific articles, and even researched the methods of the greatest investors of all time. I put together a roadmap with all the fundamental skills required to master the field of Quantitative Finance and Investing (detailed below), and elaborated a plan to focus on one single skill at a time.

“If I want to do this for a living, and I want to be good at it, I better give my best shot.

Warren Buffet, Jim Simons... “Can I get to that level?

I don’t know, but let’s find out””

One of the things that captured my attention the most was how hard it is to beat the financial market, and how only a handful of skilled investors (the GOAT mountain of investing: Ben Graham, Jack Bogle, Warren Buffet, Jim Simons…) have managed to do so consistently over long periods of time. “Can I get to that level?” — the most ambitious part of me dared to ask. “I don’t know but, let’s find out”, responded with curiosity my heart.

And ever since then, it has been that curiosity to see how far I can push what has led me down the path of mastering the art of Finance, Investing and Quantitative Research.

I like to think that the field of Quantitative Finance & Investing is the equivalent of a decathlon in athletics. Same as a decathlon is composed of 10 different events that athletes need to master to be competitive at the sport, in Quantitative Finance & Investing there are several disciplines that need to be mastered in order to become an expert in the field.

Below, I present the maps of what I consider are the main domains of Quantitative Finance & Investing, detailing my personal knowledge, skillset and practical experience in each of them:

1

Map | Knowledge/Skills | Experience

Mathematics

1

Map | Knowledge/Skills | Experience

-

Coursework:

Elementary Algebra --> algebraic expressions, solution of algebraic equations, inequations, functions...

Linear Algebra --> courses in vector spaces, matrices & linear transformations, transformation matrices, vector basis, eigenvectors & eigenvalues, matrix decompositions, tensors, non-linear transformations...

Abstract Algebra --> algebraic spaces & structures, group theory, ring theory, field theory, module theory, homomorphisms, isomorphisms, automorphisms...

-

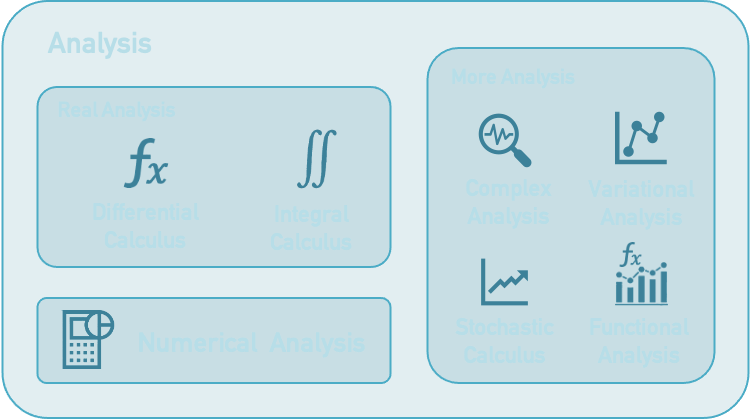

Coursework:

Real Analysis/Calculus --> Real-valued Functions, Differential Calculus, Limits, Derivatives, Integral Calculus, Sequences, Series, Integrals, Multi-variate Calculus, Ordinary Differential Equations, Partial Differential Equations...

Complex Analysis

Variational Analysis --> courses in Convex Analysis, Optimization Theory...

Harmonic Analysis --> Fourier Analysis, Convolutions...

Numerical Analysis --> courses in Finite Element Analysis, Taylor Series, Newton-Raphson, Runge-Kutta, Euler Numerical Methods, Lagrange Interpolation...

Probabilistic Analysis --> Bayesian Analysis, Stochastic Calculus, Ito Calculus...

-

As "Quant of the Year" Marcos Lopez de Prado states: "Geometric solutions are particularly powerful to solve Finance problems":

"The goal of my research is to forecast financial systems and make optimal decisions under uncertainty. In order to achieve that, I may apply probability theory, inferential statistics, vector spaces, stochastic calculus, etc. However, when possible, I prefer to state a problem Geometrically or Topologically, because it gives me the leverage to comprehend it before committing equations to a paper."

"For example, here is a Geometry work from Ronald Fisher dealing with Karl Pearson 's (Geometry professor at Gresham College) most famous invention: Correlation. Geometry is the right way to think about correlations. And when it comes to understanding complex dynamic systems with logical and hierarchical relationships, Topology is the way to go!"

-

Courses in Linear Optimization, Convex Optimization, Non-Convex Optimization, Dynamic Programming Optimization, Optimal Control Theory, Integer Optimization, Gradient-Based Optimization (Gradient Descent, Newton Methods...), Stochastic Optimization, Robust Optimization...

-

Coursework:

Physics --> Classical Mechanics, Orbital Mechanics, Quantum Mechanics, Relativity Theory, Thermodynamics, Electromagnetism, Optics.

Electrical Engineering --> Courses in Control Theory, Electronics, Embedded Systems, Telecommunications, Signal Processing, Robotics...

Mechanical Engineering --> Structures, Processes & Fabrication...

Aerospace Engineering --> Flight Dynamics, Propulsion & Engines, Aerodynamics, Astrodynamics, Rocket & Launchers Theory, Satellite Systems...

Systems Engineering

I possess a strong background in Math, Physics and Engineering, acquired throughout my B.Sc. and two M.Sc. in Aerospace Engineering and Space Systems.

In aggregate, I have accumulated more than 7+ years of education learning to understand and model physical phenomena by means of differential equations and mathematical expressions.

Mathematics

1

Map | Knowledge/Skills | Experience

Mathematics

2

Map | Knowledge/Skills | Experience

Probability & Statistics

2

Map | Knowledge/Skills | Experience

I possess good foundations in Probability & Statistics, developed through several uni courses, the CFA curriculum, and further enhanced by personal research.

As I consider P&S is a key field to understand quantitative finance, in order to fill knowledge gaps I have taken a hands-on approach and conducted research from several sources to create my curated map of probability and statistics (see below).

-

Coursework:

Probability Theory --> courses in Foundations of Probability Theory, Measure Theory, Probability Spaces, Kolmogorov Axioms of Probability Theory, Probabilistic Experiments, Random Variables & Random Probabilistic Processes...

-

Coursework:

Combinatorics --> general principles of counting, counting outcomes in sampling with replacement (multiplication principle, stars and bars formula), counting outcomes in sampling without replacement (multinomial formula, sorting, permutations, combinations, labeling...)

-

Coursework:

Random Variables--> formal definition of random variables, properties of random variables, random variables elements (sample space, event space, probability measure), random variables moments, entropy, functions of random variables, convergence and theorems...

Probability Distributions --> probability distribution formal concept, Probability Distribution Function (PMF/PDF), Cumulative Distribution Function (CDF)

Main Discrete and Continuous Probability Distributions --> Uniform Distribution, Bernoulli/binomial Distribution, Geometric Distribution, Poisson Distribution, Normal Distribution, Lognormal Distribution, General Gamma Distributions, General Stable Distributions, Generalized Pareto, Frechet, Weibull, & Gumbell Distributions, T-Distribution and F-Distribution...

-

Coursework:

Probabilistic Processes --> Formal Definition of Probabilistic Processes, Deterministic & Stochastic Processes

Characteristics of Stochastic Processes --> Time & Time Point Processes, State-Space Point Processes, State-Space Continuity, Probabilistic & Statistical Properties of Random Variables: Independence, Stationarity, Markov Property, Martingale Property, Homogeneity, Almost Sure Continuity, Sample Path Continuity, Probability Continuity...

Main Stochastic Processes --> Diffusion Processes, Jump Processes, Markov Process, Martingale Process, Random Walk, Geometric Process, Wiener Process, Ito Process, Geometric Brownian Motion, Cauchy Walk/Flight, Lévy Walk/Flight, Renewal Point Process, Poisson Process...

“Probability is amongst the most important science, not least because no one understands it”

-

Coursework:

Measures of Frequency Distribution --> Frequency, cumulative frequency, Frequency Distributions, Histograms...

Measures of Central Tendency --> Arithmetic Mean, Weighted Mean, Geometric Mean, Harmonic Mean, Mode, Median

Measures of Location --> quantiles and percentiles

Measures of Dispersion --> Deviation, Mean Absolute Deviation, Variation, Variance, Standard Deviation, SemiVariance, SemiDeviation, Covariance, Correlation, Coefficient of Variation, Chebyshev's Inequality

Measures of Skewness --> Symmetric, Negatively and Positively Skewed Distributions

Measures of Kurtosis --> Platykurtic, Mesokurtic and Leptokurtic Distributions

-

Sampling --> Population and Sample Variables, Distributions, Law of Large Numbers, Central Limit's Theorem, Types of Sampling (Probability and Non-Probability, Simple Random Sampling, Stratified Sampling, Systematic Sampling...), Sampling Biases, Steps of Sampling Process...

Estimation --> Estimators, Estimates, Point Estimate, Interval Estimate, Confidence Intervals, Maximum Likelihood Estimator, Characteristics of Ideal Estimators & Estimates, Steps of Estimation Process, Frequentist Inference Bayesian Inference....

Hypothesis Testing --> Alternative and Null Hypothesis, Test Statistic, p-value, Critical Regions, Rejection Points, Significance Level, Errors in Hypothesis Testing (Type I and Type II Errors)...

-

Logistic Regression

Simple Linear Regression --> Linear Regression Equation, Assumptions of Linear Regression Models, Construction of a Linear Regression Model, Analysis of Variance (ANOVA), Coefficient of Determination, F-Statistic...

Multiple Linear Regression

Non-Linear Regression

-

Concepts --> Linearity, Stationarity, Autocorrelation, Serial Correlation, Homoskedasticity, Heteroskedasticity, Multicollinearity, Cointegration, Dickey Fuller Test (Nonstationarity), Durbin Watson Test (Autocorrelation), Dickey Fuller-Engle Granger Test (Cointegration)

Time-Series - Basic Trend Models --> Linear Trend Model, Log-Linear Trend Model, Limitations...

Time-Series - AutoRegressive Trend Models --> AR Model, ARCH Model, GARCH Model...

Double Time-Series Models

Random Walk Processes

-

For further information, see my project: "Statistical Analysis of EROSS+ Satellite GNC System by Monte Carlo and Linear Covariance Analysis"

Probability & Statistics

2

Map | Knowledge/Skills | Experience

Probability & Statistics

3

Map | Knowledge/Skills | Experience

Computer Science

3

Map | Knowledge/Skills | Experience

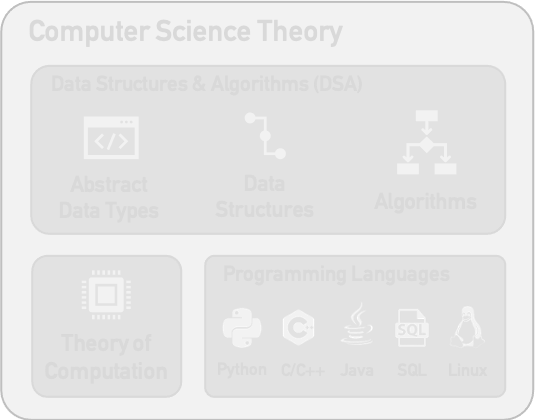

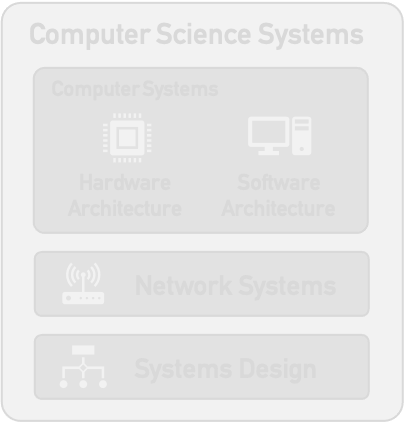

Like most engineers, I only learned computer science/coding superficially during my Bachelors/Masters, as it was needed to model physics and engineering equations. Working as a Quant Developer at Morgan Stanley helped me grasp the importance of a solid foundation in Computer Science to thrive in any data related position nowadays.

Since then, I have taken a deep dive into the fundamentals of Data Structures and Algorithms (created a GitHub repository with all relevant knowledge and coding exercises, beginner to advanced), I’ve mastered 1+8 Programming Languages (advanced level in Python, plus I’ve done projects in C++, JAVA, MATLAB, R, q/kdb (SQL), HTML/CSS/JS, SwiftUI, Linux/Unix), and I’ve acquired +2years of DevOps experience at Morgan Stanley.

-

Created personal DSA GitHub Repository containing a structured, curated collection of all DSA technical concepts and the 100 most relevant DSA coding problems, with their explanation:

Abstract Data Types --> Primitive Numerical Types, Sequence Types (Byte, String, List, Stack, Queue), Maps and Sets.

Data Structures --> Arrays, Linked Lists, Hash Maps, Trees and Graphs.

Algorithms --> Algorithmic Programming Techniques (Recursion, Dynamic Programming, Two Pointers, Sliding Window, Backtracking, Greedy), Search Algorithms, Sorting Algorithms, Graphs Algorithms, Kadane's Algorithm, Dutch National Flag Algorithm...

-

Back End:

C++

JAVA

q/kdb (SQL)

Linux/Unix

Front-End:

HTML / CSS / JavaScript

SwiftUI (iOS)

Markdown

LateX

-

Analytic Software:

MATLAB

R

Excel/VBA

Libraries/Tools:

Pandas (Python)

Scikit-Learn (Python)

PyTorch (Python)

TensorFlow

-

DataBases:

Relational DBs (q/kdb+, MySQL, PostgreSQL)

Non-Relational DBs (NoSQL, MongoDB, Cassandra)

Version Control:

Git

Containerization:

Docker

Kubernetes

Jenkins

Cloud

Computer Science

3

Map | Knowledge/Skills | Experience

Computer Science

4

Map | Knowledge/Skills | Experience

Data Engineering & Data Science

4

Map | Knowledge/Skills | Experience

Throughout my 2.5 years at Morgan Stanley, I have leveraged my expertise in Data Engineering operations to handle complex datasets of financial statements KPIs and implement quantitative models for in-depth analysis.

In addition to data engineering, I posses a solid background in Data Science with proficiency in data analysis, analytics and model development. I’ve completed Google’s Professional Certification in Data Analytics, and applied the learned skills in several projects, both professionally and independently (see next tab).

I love extracting insights from data, and deriving data-driven strategies that deliver tangible results.

-

Data Problem Definition

Data Collection

Data Movement & Storage

Data Warehousing and ETL (Extract, Transform, Load) --> Over 2.5y working at MS I've gained understanding on how to design, build, and manage data warehouses and implement ETL pipelines to move, transform, and integrate data from various sources.

Databases and Query Languages --> Proficiency in relational databases (q/kdb, SQL) and familiarity with non-relational databases (NoSQL, MongoDB, Cassandra) for handling both structured and unstructured data.

Big Data Technologies --> Familiarity with distributed systems/tools (Apache Spark, Kafka...) to handle large-scale data processing & streaming.

Cloud Platforms --> Experience with cloud-based data services (e.g., AWS, Google Cloud, Azure) for scalable storage, processing, and deployment.

Data Pipeline Orchestration--> Familiarity with tools like Apache Airflow or Prefect to automate and manage data workflows and pipelines.

Data Governance and Security --> Knowledge of data governance principles, privacy & security measures to ensure data integrity, compliance, & protection.

Data Processing -->

Data Cleansing --> data validation, formatting, deduplication, error correction, outlier management...

Data Wrangling --> data parsing, data transformation, data integration, data enrichment, aggregations, feature engineering...

Data Modeling --> development of quantitative models and calculations to transform data into the desired output.

-

Exploratory Data Analysis --> descriptive analysis and data investigation to uncover underlying structure, relationships, outliers...

Data Analytics and Insights finding --> segmentation, diagnosis analysis, causal analysis, inferential analysis, predictive analysis, prescriptive analysis...

Data Visualization --> exploratory visualization, time-series visualization, statistical visualization, multi-variate visualization, geospatial visualization, network visualization, interactive visualization, explanatory visualization...

Data Sharing & Presentation -->

During my internship at the start-up Drotium, I held more than 30 conferences to students, professors, politicians, Private Equity investors... presenting our research in Positioning Systems for Automatic Vehicles.

I've also held scientific papers presentationsat journal conferences (e.g. Hybrid Artificial Intelligence Systems (HAIS) 2024), and gave talks for the Morgan Stanley Fixed Income Strats about FID quantitative models.

-

Implemented all steps of Data Analytics & Model Development Process for both professional and personal projects (see in next tab) —>

Model Building & Development

Model Training

Model Evaluation & Testing

Model Tuning & Optimization

Model Deployment

Model Monitoring & Maintenance

Model Documentation & Reporting

Data Engineering & Data Science

4

Map | Knowledge/Skills | Experience

Data Engineering & Data Science

5

Map | Knowledge/Skills | Experience

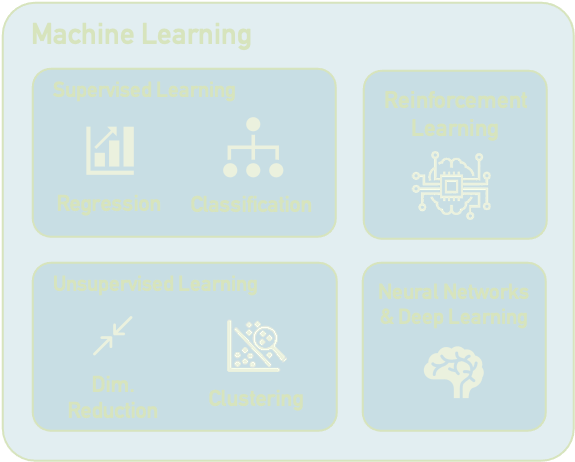

Machine Learning & AI

5

Map | Knowledge/Skills | Experience

-

Regression —> Linear Regression (single variable and multivariate), Non-Linear Regression, LASSO Regression, Regression Trees, Ensemble & Random Forest

Classification —> Logistic Classification, Classification Trees (CART), Support Vector Machine (SVM), K-nearest neighbor (KNN)

-

Dimensionality Reduction —> Factor Analysis, Principal Component Analysis (PCA)

Clustering —> K-means Clustering, Hierarchical Clustering

-

Feedforward Neural Networks (FNN) —> Single-Layer Perceptron (SLP), Multi-Layer Perceptron (MLP)

Artificial Neural Networks (ANN)

Recurrent Neural Networks (RNN) —> simple RNN, Gated Recurrent Unit (GRU), Long Short-Term Memory (LSTM)

Convolutional Neural Networks (CNN) —> Fully Convolutional Networks (FCC), Residual Networks (ResNet), DenseNet

Graph Neural Networks (GNN) —> Graph Convolutional Networks (GCN), Graph Attention Networks (GAT), GraphSAGE

Transformers —> primarily used for Natural Language Processing (NLP) such as Bi-directional Encoder Representations from Transformers (BERT), or Generative Pre-trained Transformer (GPT)

Deep Neural Networks (DNN) —> more than two hidden layers

-

Model-Based Learning —> Dyna-Q, Monte Carlo Tree Search (MCTS)

Model-Free Learning —> value-based (Q-learning, SARSA), policy-based (REINFORCE, Policy Gradient Methods)

Hybrid Learning

Deep Reinforcement Learning

-

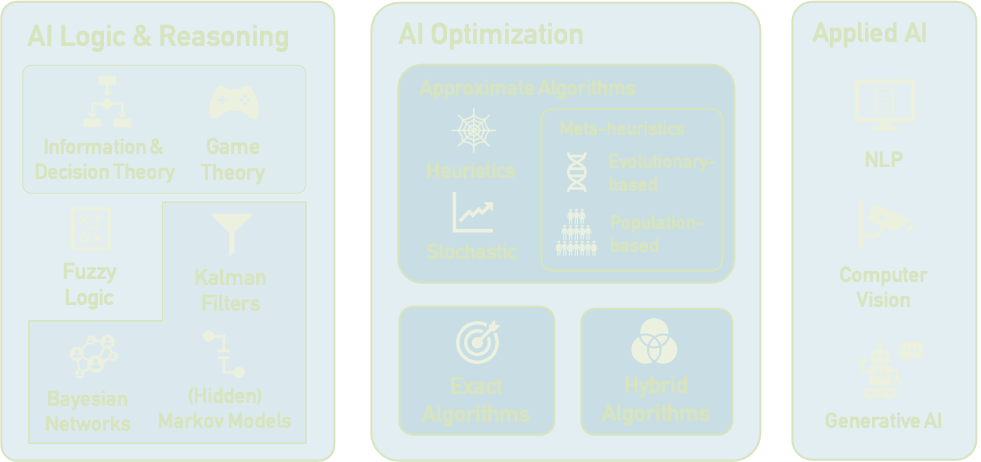

Exact Algorithms —> Linear Programming, Non-Linear Programming, Gradient-Based…

Approximate Algorithms —> Stochastic Optimization, ML Optimization, Heuristics, Meta-heuristics:

Single Solution Based Meta-heuristics —> Simulated Annealing, Tabu Search, Local Search, Nelder-Mead…

Population Based Meta-heuristics —> Evolutionary Algorithms (Genetic Algorithms, Memetic Algorithms…), Swarm Based Algorithms (Particle Swarm Optimization (PSO), Artificial Bee Colony (ABC)…)

Hybrid Algorithms

-

Logic —> Computational Logic, Propositional Logic, Fuzzy Logic...

Reasoning/Decision Making —> Information Theory, Decision Theory, Game Theory...

Uncertain Reasoning —> Bayesian Networks, (Hidden) Markov Models, Kalman Filters...

After taking several courses in the topic, I am currently deepening my expertise in Machine Learning & Artificial Intelligence (ML & AI) through my ongoing PhD thesis in ML applied to Asset Forecasting and Predictive Portfolio Optimization..

I regard Artificial Intelligence as one of the main forces that can completely revolutionize finance and investing, and that’s what has motivated me to pursue a PhD in the topic, and keep expanding my knowledge in this dynamic and developing field.

Alongside my academic work, I am increasing the depth of my personal ML & AI Knowledge Map (see below) and engaged in the development of my own ML Predictive Algorithms Library in Python, gaining hands-on experience in building and testing AI models for diverse financial applications (see projects in next tab).

Machine Learning & AI

5

Map | Knowledge/Skills | Experience

Machine Learning & AI

6

Map | Knowledge/Skills | Experience

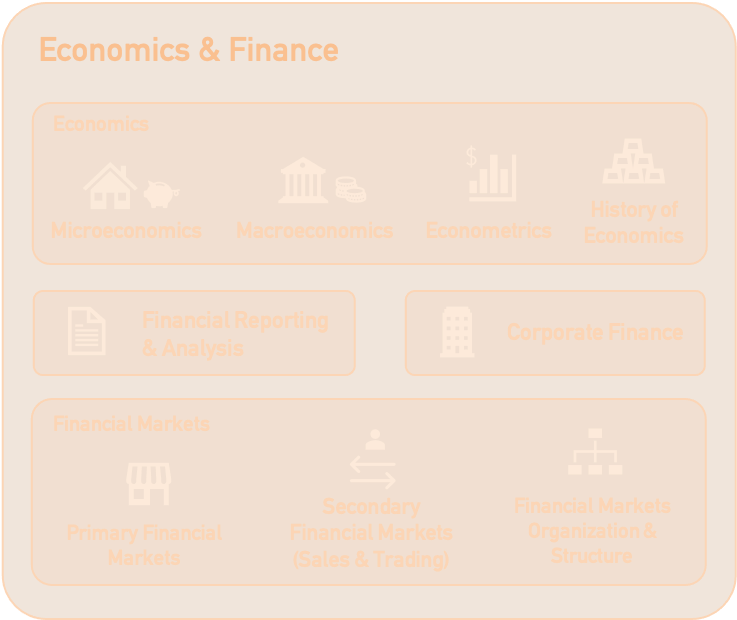

Quantitative Finance

6

Map | Knowledge/Skills | Experience

I am completely self-educated in Finance, a field that first captivated me while studying for the CFA exam during my M.Sc. in Aerospace Engineering. Despite the challenge of balancing both, I found (Quantitative) Finance even more captivating than my uni courses, and ever since then that curiosity to understand and learn more about the topic has only kept growing.

Over the last 5 years I have been combining studies/work with the study of Finance, progressing through the CFA Certification, my PhD in Financial ML, and expanding knowledge through personal research of the topics I find more interesting (fixed income valuation, derivatives pricing, portfolio optimization..). In addition, I’ve taken a hands-on approach and applied the learned theoretical knowledge to personal projects to master the practical side of trading & investing (see my projects in the next tab).

Finance

-

Microeconomics —> supply & demand analysis, market structures (perfect competition, monopolies, oligopolies, Nash equilibriums)...

Macroeconomics —>

GDP, Aggregate Supply & Aggregate Demand

Economic Growth and Sustainability —> Solow Growth Model, Labor Productivity Function…

Unemployment & Inflation —> Activity ratios, Unemployment Rates, Price Indexes and Measures of Inflation…

Monetary & Fiscal Policies —> Functions & Types of Money, Quantitative Theory of Money, Money Supply & Demand, LM-IS Model, Fisher Effect, Central Banks & Monetary Policy, Money Transmission Mechanism, Governments & Fiscal Policies, Fiscal Multiplier…

Business Cycles —> Phases of Business Cycle, Theories of Business Cycle (Neo-classical, Austrian, Keynesian, Monetarist, New Classical…)

International Trade & Capital Flows —> Exports, Excess Demand and Excess Supply, Absolute and Comparative Advantage, Trade Restrictions (Tariffs, Quotas, Export Restraints, Export Subsidies…), Trade Agreements, Balance of Payments…

Foreign Exchange Markets —> Exchange Rates (Nominal, Real), Exchange Rate Regimes (Floating Rates, Managed Float, Fixed Parity, CBS…), Exchange Rate and Trade Balance...

Econometrics —> Ordinary Least Squares (OLS) regression, Instrumental Variables (IV) estimation, Time Series Analysis, Panel Data Models, Causal Inference (DiD and RDD)…

-

Financial Reporting & Analysis (Accounting) —> Financial Reporting Standards and Quality, Accounting Methods, Income Statement Analysis, Balance Sheet Analysis, Cash-Flow Statement Analysis, Financial Ratios…

Corporate Finance —> Corporate Governance & ESG, Capital Budgeting, Company Capital Structure, Cost of Capital (WACC, Cost of Debt, Cost of Preferred Stock, Cost of Common Equity), Company Cost Structure, Measures of Leverage, Working Capital Management…

-

Markets Organization & Structure —> Financial Market Stakeholders (Users & Intermediaries), Types of Financial Markets (Primary, Secondary…), Classification/Classes of Financial Assets, Market Positions (Long, Short, Leveraged…), Market Orders & Instructions…

Efficiency of Markets

Fundamental Market Analysis (Industry & Company Analysis)

Market Indexes

Financial Assets —> characteristics, types, payoff structure, trading markets, return, risks… of main financial assets:

Equity

Fixed Income

Derivatives

Pooled Investment Vehicles

Commodities

Real Estate

FX

Crypto

Other Alternative Investments

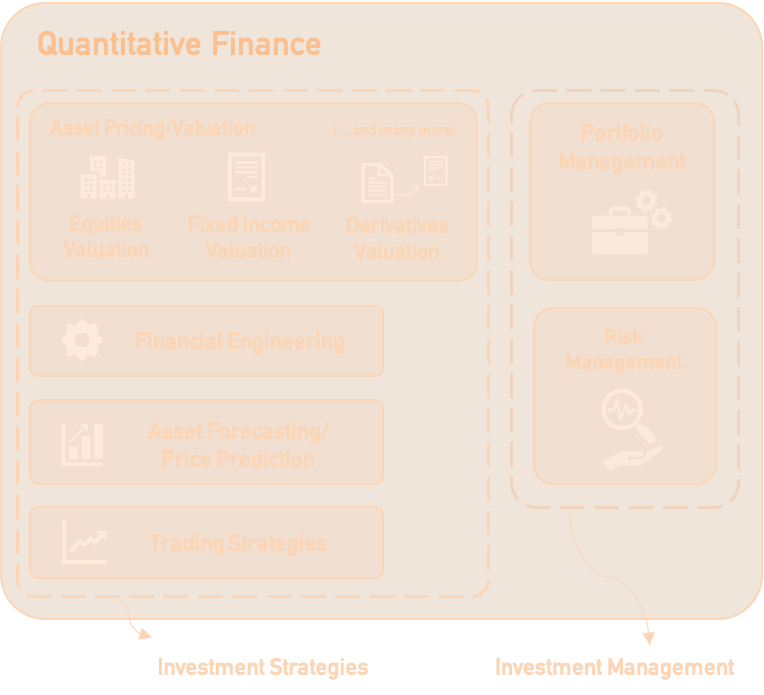

Quantitative Finance

-

Financial modeling and financial engineering provide the tools and frameworks needed to design the quantitative models used in finance and quantitative finance fields:

Financial Models:

Economics —> Supply & Demand Analysis Models, Economic Growth Models, Quantitative Theory of Money, LM-IS Model…

Financial Reporting/Accounting —> Financial Statement Modeling

Corporate Finance —> Capital Budgeting Models, Cost of Capital (WACC model)..

Quantitative Finance Models:

Asset Pricing/Valuation

Asset Forecasting

Trading Strategies

Portfolio Optimization & Management

Risk Management

-

General Valuation Principles —> Time-Value of Money, Discounted Cash Flow (DCF) Analysis, …

Equity Valuation:

Discounted Cash Flow Models —> Dividend Discount Model (DDM), Gordon Dividend Discount Model (GDDM), Multi-Stage Dividend Discount Model (MS-DDM), Free Cash-Flow to Equity Valuation Models…

Market Multiples Models —> Price, Fundamental, Comparables, Enterprise Value Multiples…

Asset Valuation Model

Fixed Income Valuation:

FI Valuation With Certain Cash Flows (option-free) —> Simple DCF bond pricing, Spot-Curve Bond Pricing

FI Valuation With Uncertain Cash Flows (embedded options) —> Term Structure Models, Binomial Tree Valuation, Monte Carlo Valuation Models

Credit Analysis Models —> Risk of Default, Loss if Default, Credit Spreads, Credit Valuation Adjustments (CVA), Credit Models (Structural Models, Reduced Form Models…)

Interest Rate Curve Modeling —> Spot & Forward Rates, Interest Rates Dynamics and Yield Curves (Par Curve, Spot Curve, Forward Curve, Swap Curve), Term Structure Models (Effective & Key Rate Duration, Factor Models, Discrete & Continuous Time IR Models, Arbitrage-Free IR Models: Ho-Lee, KWF Model…)

Derivatives Valuation:

Valuation of Forward & Future Contracts —> No Arbitrage Pricing (Carry Arbitrage Model), Equity Forwards, Fixed-Income Forwards, FRA Valuation

Valuation of Swap Contracts —> Valuation of Interest Rate Swaps (IRS), Equity Swaps, Currency Swaps…

Valuation of Option Contracts —> Risk Neutral Option Pricing (Martingale Measure Approach), Analytical Pricing Methods (Black Scholes Model, Lévy/Diffusion Models, Stochastic Volatility Models…), Numerical Pricing Methods (Binomial Valuation Model, Monte Carlo Simulation, Variance Reduction Methods, Finite Difference Valuation Methods…), Pricing of European vs American Options…

Real Estate Valuation (Appraisal) —> Income Approach (Direct Capitalization vs DCF), Comparables Sales Approach, Cost Approach, REITs Valuation (DCF Approach, Price Multiples Approach, Asset Value (NAVPS) Approach)

Commodities Valuation —> Supply & Demand Analysis (Stock & Flow Analysis, Components Analysis, Money Flows…), Global Economic Conditions (Volatility Analysis), Commodity Futures Pricing (Contango, Backwardation…), Commodity Swaps Valuation (TRS, ERS, Basis Swaps, Volatility Swaps, Variance Swaps…)

-

Types of Forecasting Analysis Methods:

Fundamental & Macro Analysis —> Company Fundamental Analysis (Financial Statements) Market Structure & Industry Analysis, Macroeconomic Analysis, Business Cycle Analysis…

Technical Analysis —> Trend Analysis, Chart Patterns, Momentum Indicators, Volume Analysis, Volatility Analysis…

Sentimental Analysis —> NLP for Financial Texts, Sentiment Scores from News/Social Media, Behavioral Finance Analysis, Event-Driven Forecasting…

Quantitative Analysis —> Quantamental Analysis, Statistical Analysis (Descriptive Analysis, Regression Analysis, Time-Series Analysis & Forecasting), Machine Learning Predictive Algorithms (Random Forests, Support Vector Machines (SVM), Gradient Boosted Algorithms, Neural Networks and Deep Learning (GRU, LSTM…), Reinforcement Learning, Hybrid Models…), Market Microstructure (Order Flow Analysis, Latency and Execution Algorithms…), High-Frequency Analysis…

Asset Classes to Forecast:

Stock Forecasting

Fixed Income Forecasting

IR Forecasting

Credit Forecasting

Commodities Forecasting

Exchange Rates (FX) Forecasting

Volatility Modeling & Forecasting —> Implied and Realized Volatility, GARCH Models, Stochastic Volatility Modeling, Volatility Clustering…

-

Trading Strategies By Risk Source:

Directional Strategies —> Long-Only, Long-Short Directional, Short-Bias, Dedicated Short, Opportunistic/Global Macro…

Event-Driven Strategies —> M&A Strategies, Distressed Restructuring, Private Issue, Special Situations Strategies (Corporate Transactions, Security Issuance/Repurchase, Division Spin-off)…

Relative-Value Strategies —> No-Arbitrage Relative Value Strategies (e.g. Volatility Trading), Fundamental Arbitrage Strategies (Cross-Market & Cross-Asset Arbitrage, Long-Short “Market-Neutral” Strategies), Statistical Arbitrage Strategies (Pairs Trading, Basket-Trading, Factor-Based Stat Arb), Market Neutral Strategies…

Multi-Strategy —> Combination of Previous Strategies, Multi-Strategy Hedge Funds, Fund of Funds…

Trading Strategies by Analysis Type:

Fundamental Strategies —> Company Analysis (Growth, Value Investing), Industry Analysis, Macro Analysis Strategies

Technical Strategies —> Pattern Recognition, Mean Reversion, Volume Analysis, ICT Trading…

Sentimental Strategies —> Market Sentiment, Investor Behavior…

Quantitative Strategies —> Quantamental Strategies, Quant Technical Strategies, Quant Sentimental Strategies, Statistical/Machine Learning Strategies, Market Microstructure Strategies, High-Frequency Trading (HFT) Strategies

Trading Strategies by Time-Horizon:

Long-Term Trading —> Holding period goes from months to years

Mid-Frequency Trading —> Holding period goes from hours to a few weeks

Short-Frequency Trading —> Holding period is a few minutes or hours at most

High-Frequency Trading —> Time from signal to action is less than a second

Trading Strategies by Approach/Philosophy:

Discretionary

Systematic

-

I) Portfolio Planning:

Understanding of Investing Needs

Development of Investment Policy Statement —> Set Investment Objectives (Risk & Return), Capital Markets Estimation, Investment Constraints

II) Portfolio Design & Construction:

Portfolio Selection Models —> Parameter-Based Models (Mean-Risk Models, 3-Parameter Models…), Utility Theory, Stochastic Dominance

Parameter Estimation —> Modeling Parameters Probability Distribution, Parameters Predictive Estimation, Handling Estimation Errors (Global Minimum Variance Portfolio, Bayesian Approaches (Shrinkage Methods, Black-Litterman Model), Robust Optimization…), Fuzzy Approaches to Parameter Estimation…

Portfolio Optimization Objectives —> Single-Objective Optimization, Multi-Objective Optimization (Weighted-Sum, Pareto-Based Method)

Portfolio Optimization Period —> Single-Period Optimization, Multi-Period Optimization (Discrete-Time, Continuous-Time)

Portfolio Optimization Constraints —> Hard Constraints, Trading Constraints, Problem Constraints…

Portfolio Optimization Techniques —> Exact Solutions, ML Algorithms, Metaheuristics (Single-Solution Based, Population-Based: Evolutionary Algorithms, Swarm-Based Algorithms…), Hybrid Algorithms

Portfolio Optimization Performance Analysis —> Portfolio Backtesting, Comparison Against Other Models/Benchmarks

Portfolio Construction/Execution/Trading

III) Portfolio Management:

Portfolio Monitoring & Rebalancing

Portfolio Risk Management

IV) Portfolio Revision & Feedback:

Portfolio IPS Revision & Updates

Portfolio Performance Evaluation & Reporting

-

Market Risk Models —> VaR, CVaR, Stress Testing, Sensitivity Analysis…

Credit Risk Models —> Credit Scoring Models, Default Probability Estimation, Merton model, Credit Derivatives (e.g., Credit Default Swaps, Collateralized Debt Obligations), Counterparty risk and mitigation techniques (e.g., netting agreements)…

Interest Rate Risk Management —> Duration and Convexity Analysis, Gap analysis (Interest Rate Gap Management), Interest Rate Derivatives (e.g., Interest Rate Swaps, Caps, Floors), Repricing Risk and Yield Curve Risk…

Currency Risk Management —> Currency Hedging (using Forwards, Futures, Options…), Translation, Transaction & Economic Exposure, Currency Swaps, Multinational Cash Flow Management…

Liquidity Risk Models —> Liquidity coverage ratio (LCR), Cash Flow Forecasting, Funding Liquidity vs. Market Liquidity Risk, Liquidity Stress Testing…

Model Risk Management —> ****Model Validation & Backtesting, Stress Testing of Models, Model Governance Frameworks, Model Risk Adjustment & Calibration…

Operational Risk Assessment —> Loss Event Data Collection, Key Risk Indicators (KRIs), Risk Control Self-Assessment (RCSA), Business Continuity Planning and Disaster Recovery…

Regulatory Risk Management —> Basel III and Dodd-Frank Compliance, Anti-Money Laundering (AML) & Know Your Customer (KYC) Regulations, Stress Testing & Capital Adequacy Requirements, Regulatory Reporting & Governance Frameworks…

Quantitative Finance

6

Map | Knowledge/Skills | Experience

Quantitative Finance

★

Projects

Contact

If you are interested in hiring me for a Quantitative Trading/Research position or simply want to get in touch, don’t hesitate to drop me a message:

Álvaro Sánchez

Quantitative Researcher

Email:

alvarosf07@gmail.com